#1: Compliance with Legal Requirements.

Far too many small business segregate their marketing into siloes and don’t cross-promote within their various channels. Instead connect your marketing methods (search engine marketing, mobile, email, content, voice, direct mail, public relations, advertising, social media, etc.) with one another—all leading back to your business and/or your website.

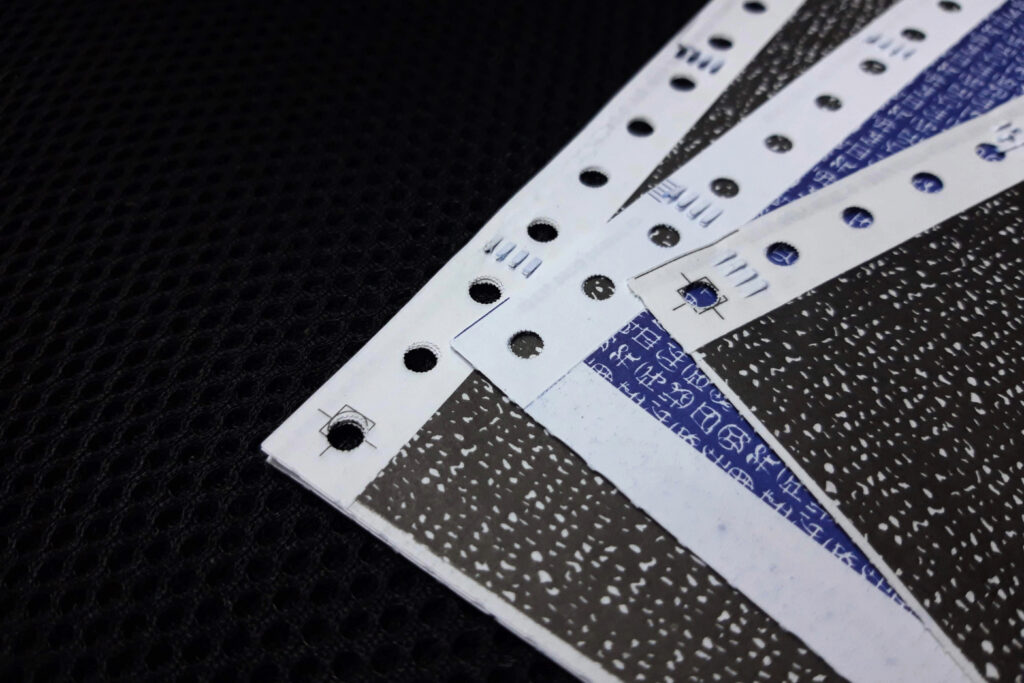

Accurate payslips are vital for maintaining employee trust and satisfaction. Employees rely on their payslips to understand their earnings, deductions, and overall financial situation. Errors in payslips can lead to confusion, frustration, and dissatisfaction, which can negatively impact employee morale and productivity. By providing precise and detailed payslips, employers can demonstrate their commitment to transparency and fairness, fostering a positive work environment and enhancing employee loyalty.

For both employees and employers, accurate payslips are essential tools for financial planning and record-keeping. Employees use their payslips to manage personal finances, apply for loans, and file tax returns. Employers rely on accurate payslips for internal record-keeping, financial audits, and compliance reporting. Ensuring payslips are accurate and comprehensive helps streamline these processes, reducing administrative burdens and improving overall financial management. This accuracy supports better financial decision-making and organizational efficiency.